Convert Your IRA to a Gold IRA: Rollovers, Transfers

Converting your existing IRA into physical gold allows you to diversify your retirement savings with a tangible asset. This process involves opening a self-directed Gold IRA, which allows you to hold IRS-approved gold and other precious metals. Depending on the type of IRA you currently have, the conversion can be completed through either a rollover or a direct transfer, each with different rules and advantages.

How to Convert Your IRA to Gold

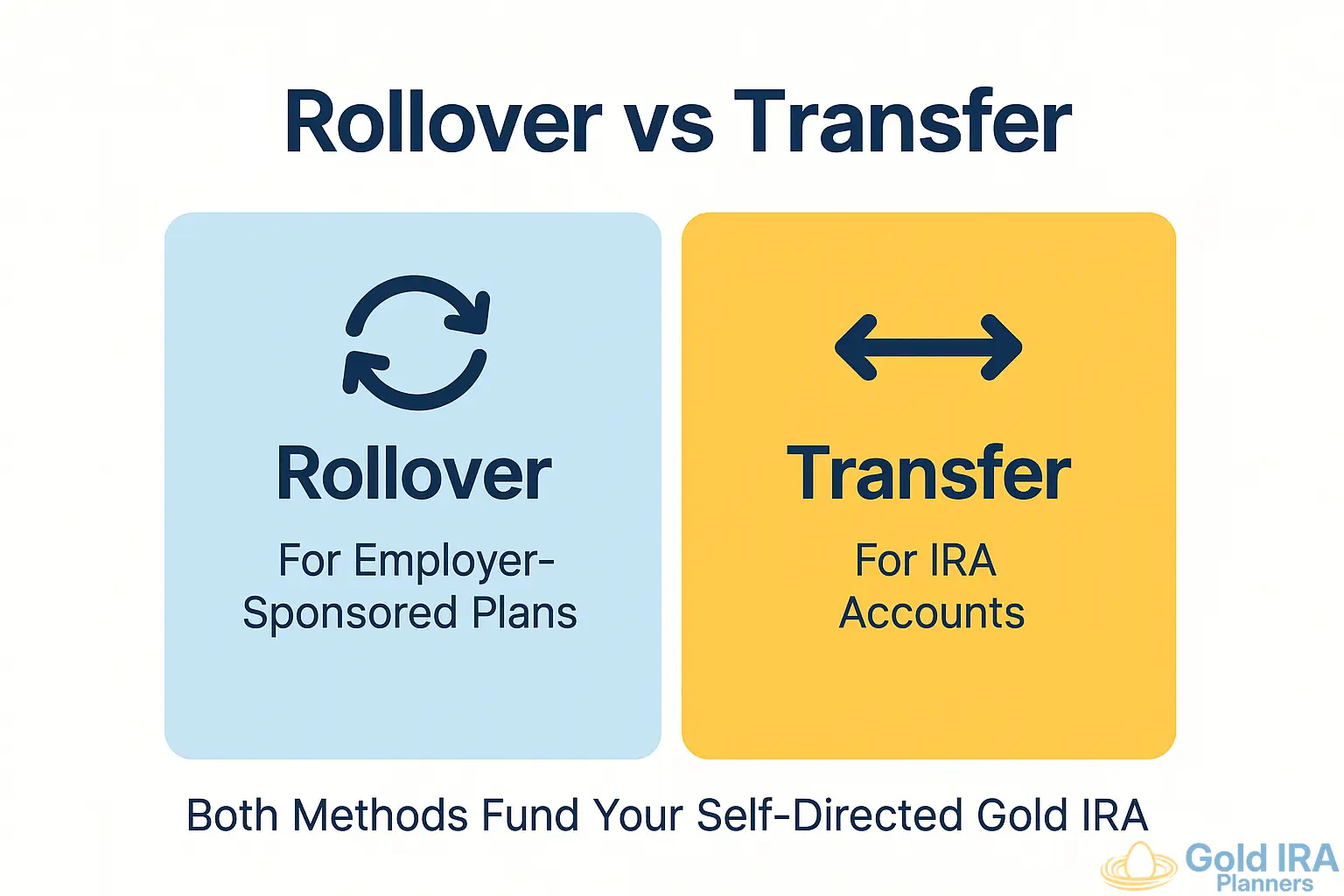

There are two IRS-approved methods to move your retirement funds into a Gold IRA: a rollover or a transfer.

- Use a rollover if you're moving funds from an employer-sponsored retirement plan, like a 401(k), 403(b), TSP, or similar.

- Use a transfer if your funds are already in a Traditional or Roth IRA.

The time it takes for a Precious Metals IRA rollover or transfer to complete varies with electronic transfers taking only a few days and manual processing taking longer up to a few weeks, especially when checks are mailed. Your eligibility depends on the type of account you currently hold (Your financial advsier can clarify this).

We explain what each method is and the entire process of how they work below so can you choose the right method to convert your retirement account.

Gold IRA Rollover (For Employer-Sponsored Plans)

A Gold IRA rollover moves funds from an employer-sponsored plan (401(k), TSP, 403(b)) into a self-directed IRA that holds IRS-approved physical gold or other precious metals.

Our Gold IRA rollover guide below details what to expect when your funds are rolled over.

How a Gold IRA Rollover Works

A Gold IRA rollover works by moving your funds from an existing retirement account into a self-directed IRA that holds physical gold. The rollover process can be done through a direct rollover, where funds move securely between custodians, or an indirect rollover, where you're temporarily in control of the funds and must redeposit them within 60 days to avoid taxes and IRS penalties. The IRS requires a 20% federal withholding on indirect rollovers, which must be replaced from other funds to complete a full rollover within 60 days.

The type of rollover you pick depends on your investment goals, speak with a financial planner. Indirect transfers can be a more complicated way to rollover funds. You'll find rollovers in Silver IRAs and other metals are the same.

Accounts Eligible For a Rollover

Only qualified retirement plans can be rolled over to a gold-backed IRA. Partial rollovers to a Gold IRA are possible, but check with your plan administrator if restrictions exist before initiating the rollover.

Gold IRA Transfer (For IRA Accounts)

A Gold IRA transfer moves funds from one IRA account to another without the account holder taking possession. Also known as a trustee-to-trustee transfer, it's a direct, tax-free movement of assets to a Gold IRA and is also commonly used to switch custodians or precious metals dealers.

How a Gold IRA Transfer Works

To initiate a Gold IRA transfer, open a self-directed IRA with a new custodian and request a transfer from your existing IRA provider. The current trustee and new self-directed IRA custodian handle the process directly, moving funds without triggering taxes or penalties. No action is needed from you beyond signing the Transfer Request Form.

IRA Transfer Eligibility

If you have a Traditional or Roth IRA, you can transfer funds into a self-directed Gold IRA. The transfer of funds allows you to move retirement savings into physical gold while keeping the tax advantages of your original account.

Types of IRAs Eligible For a Transfer

You can convert a portion of your IRA balance to a Gold IRA, with the amount converted taxed if it originates from a pre-tax account. Only qualified plans can transfer assets into a Gold IRA. Check with your financial adviser to see if your specific Individual Retirement Accounts can be converted first, before starting the process.

Requirements in a Rollover/Transfer

When converting a retirement account to a Gold IRA, there are specific requirements if you choose a rollover or a transfer including:

Rollover Requirements

- An indirect rollover must be completed within 60 days of receiving the funds.

- Limited to one rollover per 12-month period. Annual limit applies across all IRAs.

- Funds must be deposited into a self-directed IRA that meets IRS requirements.

- Missing the 60-day rollover rule may trigger tax penalties or a taxable withdrawal.

Transfer Requirements

- Must be a direct custodian-to-custodian transfer (you never take possession during the movement of funds).

- No limit on the number of transfers you can make.

- Transfers are tax-free and not treated as distributions (You keep the tax benefits).

Conversion Rules

- Assets like mutual funds and stocks cannot move in-kind to a Gold IRA and instead must be liquidated before funding the account.

- Roth conversions to a self-directed Gold IRA are permanent and cannot be re-characterized or undone since the Tax Cuts and Jobs Act of 2017.

It's crucial these rules are followed during the rollover to avoid common mistakes. Mistakes you may see include missing the 60-day deadline, triggering taxes by receiving funds personally, rolling over RMDs, or violating the one-rollover-per-year rule.

To stay compliant beyond the funding process, you'll need to follow all Gold IRA rules for qualified funds, eligible metals, storage, and distributions.

Costs in a Gold IRA Conversion

During the conversion process, you may face a minor fee to initiate the rollover or transfer with your custodian. Most Gold IRA companies will waive these costs when minimum investment thresholds are met. Gold IRA rollover fees are more common with 401(k) rollovers and indirect rollovers.

There are also one-time Gold IRA fees when you fund the self-directed IRA account, alongside wire fees. Precious Metal IRAs can involve several different types of costs when opening and owning the account including ongoing expenses which can impact the investment.

Which Companies Help With Gold IRA Conversions?

While the rollover or transfer process is handled through custodians, most investors work with a Gold IRA company to guide them through setup, custodian coordination, and purchasing IRS-approved metal products. We've reviewed the top companies that specialize in Gold IRAs, including those offering the best support, fee transparency, free Gold IRA kits, and secure storage options.

After helping you convert your account, these precious metals specialists will help you allocate gold coins and gold bars like the American Gold Eagle and PAMP Suisse bars to your new Gold IRA through a streamlined process. Rollover companies specialize in the process from start to finish, ensuring you avoid potential penalties.

Use Gold IRA Planners Before You Convert Your IRA

There's more to retirement planning for a Gold IRA than just executing a rollover or transfer. Investing in a Gold IRA also means understanding IRS-approved precious metals, storage requirements, distribution rules, and long-term costs in retirement portfolios. Before you convert, take time to plan how a Gold IRA fits into your overall retirement strategy, not just how to fund it.