SIMPLE Gold IRA: Investing in Gold Through a SIMPLE IRA

A SIMPLE IRA's funds can be used to purchase physical gold for retirement diversification. A Gold SIMPLE IRA transfer allows investors to buy gold and other precious metals in retirement, benefiting from the tax benefits of these retirement accounts.

Gold IRA Planners explains the process of converting your SIMPLE IRA to gold, from how it works to the steps to transfer your SIMPLE IRA to a Gold IRA.

What is a SIMPLE IRA & Can It Hold Gold?

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a simplified employer-sponsored retirement plan for small businesses that have up to 100 employees. SIMPLE IRAs are easier to set up and administer and usually comes with lower costs compared to other options.

A SIMPLE IRA cannot hold gold directly and must instead be converted to a self-directed Gold IRA, which itself can be a SIMPLE IRA as long as it is self-directed.

Two-Year Participation Rule

For the first two years of a SIMPLE IRA, you may only perform trustee-to-trustee transfers into another SIMPLE IRA. Any other rollover or distribution during this period is treated as an early withdrawal and incurs a 25% tax penalty (rather than the standard 10%).

After completing the two-year waiting period, you can transfer SIMPLE IRA funds into other IRA types (Traditional, SEP, Roth), provided:

- The transfer is not between Roth and non-Roth accounts.

- Both the originating SIMPLE IRA plan and the receiving IRA plan explicitly allow the rollover.

Contribution limits for SIMPLE IRAs are lower than 401(k)s and other employer-sponsored plans with the limit at $16,500 in 2025. Self-employed individuals can open a SIMPLE IRA under the same eligibility rules and contribution limits.

Early Withdrawal Penalty for Metals

If you withdraw funds before age 59½ from any tax-deferred IRA (including a SIMPLE IRA converted for gold/silver), you face a 10% early withdrawal penalty plus ordinary income tax. To avoid this penalty and potential tax errors when moving money for gold or silver purchases, always opt for a direct rollover between custodians. This ensures funds never enter your hands and preserves the IRA's tax-deferred status.

Converting a SIMPLE IRA to Gold: How It Works

A SIMPLE IRA can be transferred to a self-directed Gold IRA without penalty after two years of participation, allowing you to hold physical precious metals in retirement. The rollover process typically takes up to 14 days, from opening to funding, and buying metals with your SIMPLE IRA funds.

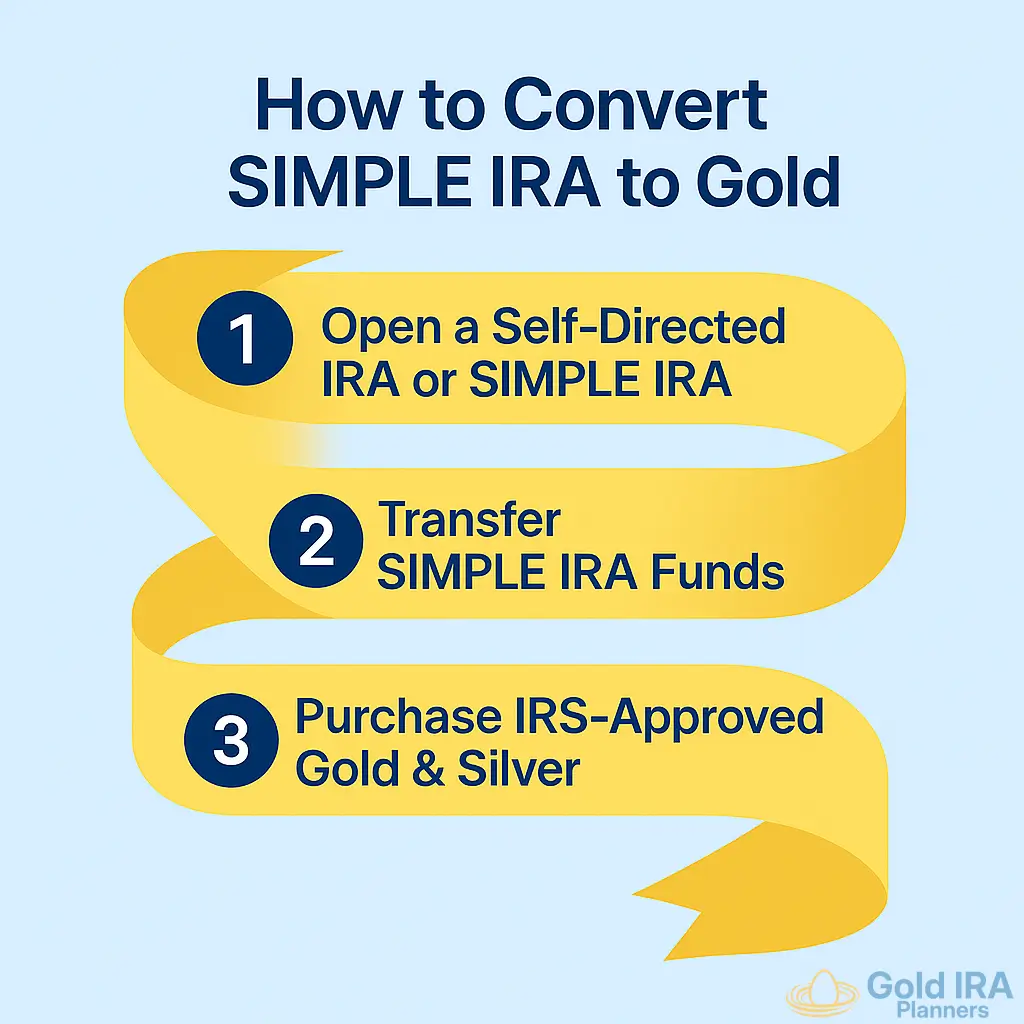

3 Steps to a Gold SIMPLE IRA

There are three steps in converting a SIMPLE IRA to a Gold IRA:

1. Open a Self-Directed Gold IRA

To hold gold with a SIMPLE IRA, start by opening a self-directed IRA with your chosen Gold IRA company. This can be a traditional self-directed IRA or a self-directed SIMPLE IRA to hold gold. This account is needed to hold precious metals in retirement with no penalties as stated by the IRS for Gold IRAs.

2. Transfer SIMPLE IRA Funds

Next, convert your SIMPLE IRA funds to the self-directed IRA. You can perform a transfer or a rollover when converting funds to a Gold IRA, depending on your retirement goals. Transfers are the common option with SIMPLE IRAs, but rollovers are still possible if you need the funds directly.

3. Purchase IRS-Approved Gold & Silver

After the self-directed IRA is funded with your SIMPLE IRA, you can then purchase precious metals allowed in an IRA like gold, silver, platinum, and palladium to hold in your retirement portfolio. The metals purchased are stored in an IRS-approved depository for secure storage and overseen by a custodian to meet storage requirements. The company you work with will help you through the 3-step process so you can easily buy gold with your SIMPLE IRA.

Costs to Move SIMPLE IRA to Gold

To pay zero fees when moving SIMPLE IRA funds to a Gold IRA, it comes down to a few factors including the Gold IRA company you choose to work with. Costs usually include setup fees, annual maintenance fees, and storage fees, but luckily there is a way to get around these fees. If you meet the purchase thresholds of some of these top Gold IRA companies, you can get all fees removed. Find out how it works in our .

SIMPLE IRA vs a Gold IRA

The investments in a SIMPLE IRA are usually individual stocks and bonds, mutual funds, and market-traded securities that are provided directly by the sponsoring company, with limited options. By moving SIMPLE IRA funds to a self-directed IRA, you can hold gold and other alternative assets allowing for a more diversified portfolio in physical and paper assets. These allow for a wider range of investment options but first a consultation with a financial advisor is recommended to assess risk tolerance.

Similar to SIMPLE IRAs, Gold SEP IRAs are set up to invest gold in a self-directed SEP IRA with their own account rules/timelines.

Before Converting Your SIMPLE IRA, Plan Ahead With Gold IRA Planners

Before converting a SIMPLE IRA to a self-directed Gold IRA, make sure you plan ahead on how you'll invest your retirement savings. Gold IRA Planners provides concise, easy-to-read Gold IRA educational materials to help you understand everything you need to know about Gold IRAs first.